##Millennials Prefer Bitcoin Over Gold, Real Estate, and Government Bonds, Survey Says

Free Crypto Signals Mobile App -

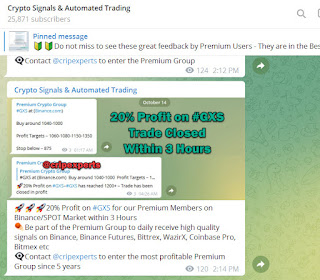

Visit - https://t.me/cryptosignalalert

For more latest news update on Cryptocurrency, Free Bitcoin Binance auto trading BOT, crypto signals mobile app & Crypto signals on Telegram join above given Telegram channel

While Bitcoin encountered lots of turbulence in the past three years, people’s perception regarding the primary cryptocurrency has improved significantly, a recent study revealed. By comparing data from 2017 and April 2020, it concluded that more people are ready to trust it over traditional financial institutions and assets, especially after the COVID-19 pandemic.

2017 Vs. 2020 Millennials Love Bitcoin

The Tokenist compiled the survey among nearly 5,000 participants in 17 countries. The company asked various questions regarding Bitcoin, the current financial situation worldwide, people’s belief in traditional financial institutions, and more.

By comparing the data with a few previous studies from 2017, this year’s results demonstrated Bitcoin’s growth in the eyes of the participants. For instance, nearly half of respondents now would rather own $1,000 in BTC over bonds, real estate, and gold. This represents an increase of 13% in the past three years.

Another report by Charles Schwab supported this narrative last year, indicating that the Grayscale Bitcoin Trust (GBTC) is the 5th most used investment instrument among millennials.

As far as familiarity goes, the overall conclusion from analyzing the 2017 and 2020 results is that people have increased their knowledge base of Bitcoin substantially, as the graph below illustrates.

Is Bitcoin Positive For The World?

The Tokenist also asked all participants if “Bitcoin is a positive innovation in financial technology?” This appeared as a somewhat relevant question, especially after the indecisive answers from the 2017 surveys. This time, however, a lot more people “strongly agreed” with BTC’s positive impact.

“Attitudes toward BTC are becoming more definite and more positive. 60% of respondents felt that Bitcoin is a positive innovation in financial technology, an increase of 27% in three years.

In 2017, 40% of respondents felt unable to assess whether the technology was a positive financial innovation. Increased familiarity with Bitcoin has convinced many that it is a positive force.”

Interestingly, the most significant growth came from female millennials and men and women aged over 65. The elderly generation appeared “strikingly more informed” and positive in 2020.

Bitcoin Vs. Banks

One of the essential questions for every Bitcoin proponent is whether or not BTC can replace traditional financial institutions such as banks. The 2020 survey touched upon this topic by asking, “if you had to choose, which of the following is more trustworthy – Bitcoin or big banks?”

“There has been a significant loss of trust in traditional banking institutions over the past three years, and Bitcoin has benefited from this. 47% of respondents trust Bitcoin over big banks, an increase of 29% in the past three years.”

Somewhat expectedly, the largest growth is visible among millennials. Contrary, only 7% of participants aged over 65 years have expressed trust in Bitcoin over big banks as this level “has stayed essentially constant since 2017.”

The report suggested that the trust increase in Bitcoin is primarily because of the “recent volatility of assets held by big banks, and the increased professionalization of the BTC sector.”

Comments

Post a Comment