###WHAT IS TEZOS – IS IT WORTH YOUR MONEY?

Free Crypto Signals Mobile App -

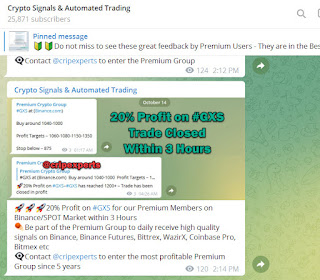

Visit - https://t.me/cryptosignalalert

For more latest news update on Cryptocurrency, Free Bitcoin Binance auto trading BOT, crypto signals mobile app & Crypto signals on Telegram join above given Telegram channel

Here we are back again exploring another digital asset in the crypto industry. Yes yes, please hold the applause (just kidding). Today, we are going to be taking a look at an up-in-coming project, Tezos. To my surprise this project has actually been around for a few years and it boasts some pretty interesting developments that we will dive into. Remember, these are supposed to be just general overviews of these projects meant to educate and spark interest for those looking to broaden their knowledge of crypto. With that being said, let’s dive into what is Tezos, and then dig deeper to give you a basic understand of all of it’s potential.

Tezos Overview

Looking at Tezos for the first time, I really had no idea what is was or what to expect. I honestly think I was turned off by how quickly this project jumped to a top 20 place on the market. Typcially, those kind of projects are pump and dumps, but in reality Tezos has maintained this top spot even moving further up slowly over time.

That was surprising to me, and let me know this project might be more than just a standard pump and dump, it might be an actual project worth investigating.

What is Tezos

This project is actually a combination of several top projects in my opinion, let me explain.

In general, Tezos is another platform and protocol for smart contracts and decentralize applications not unlike Ethereum or EOS. Not very impressive, but the project takes it a bit further by implementing several key factors from other top projects like multi-layer solutions, delegated proof of stake, and a function based coding language.

This means that the underlying code base of Tezos allows some mathematical provability to limit the chances of bugs and security issues within the code. This is mainly used when developers write smart contracts that are executed autonomously and can end up transacting millions of dollars. The additional layer of security and mathematical provability for smart contracts is not far from the implementation that Cardano is trying to do which is impressive.

Tezos ICO

The Tezor ICO was actually back in mid 2017 which was a surprise to me. I thought it was a much newer project due to its prolonged surge to the top of the market in 2019. The Tezos ICO ended up raising over $230 million which is by far no easy feat and extremely impressive. This was during the ICO craze, so it is very likely that a project with as much potential as this raised a huge amount like that.

Tezos strategically used these funds to survive the 2018 bear market, and then positioned itself well to surge in 2019 shooting to the top of the market. There could be many reasons for this surge, but nonetheless it speaks directly to the team’s marketing and financial talents. Talents like this will definitely help bolster the life-time of a project and give it huge chances to succeed.

From knowing that the platform is a delegated proof of stake algorithm, then the answer is obviously yes – you can stake your Tezos. Although, there is a requirement to creating your own staking node on the network. The requirement is that you own at at least 1,000 tokens.

Originally, you needed 10,000 tokens, but already the community reduced to threshold to enable more people to stake. Once you have become your own node, so to speak, you are called a Baker on the network. The largest Bakers get to decide things like staking payouts, propose network changes, and host most of the block confirmations. Another way to stake besides doing it yourself is by delegating your tokens to one of the top Bakers.

By doing this, they will share apart of their staking rewards with you which is usually around 5%-6% on average. In addition, you get to support which ever Baker’s morals and fundamentals align with your views. This is how the top bakers maintain their stake or lose portions of it based on how they vote. Very similar to government representative for states or countries in a democratic nation.

For example, when new proposals are introduced to the network for upgrades or changes the top Bakers get to vote. If the proposal passes through 4 series of tests, and has a overall majority support of 81%, then the proposal will pass and be introduced to the network as an upgrade to the code.

This was already done successfully with the change in Baker requirements from 10,000 tokens to only 1,000.

Biggest Competitors

The largest competitors for this project are clearly the other smart contract and dapp platforms.

Although, Tezos is most of a mash up between several of these projects. For instance, it takes the traditional smart contract and turing complete code base for its protocol from Ethereum. It also takes its consensus model from EOS with it’s delegated proof of stake. Finally, it uses a function based language that it developed to have formal verification for its smart contracts like Cardano.

Truly it is a interesting project that is trying to combine the best of most of the top projects into one. While it is thought provoking, there is not a lot of new or innovative features on the platform that other projects have not already done, or tried to do. Instead, they seem to take the best from several projects and try to use them for improved utility of the platform.

Tezos Projections

Regardless of my position on the project, the team or the fundamentals, the project is undeniably a great addition to the crypto ecosystem. It has all the potential of most of the other top projects, plenty of funding from its ICO, and a huge community that supports it.

In addition, this project has found its way to all of the largest exchanges which is impressive considering it is even offered on Coinbase, the largest retail exchange on the market.

Is It Worth Investment?

The big question is here. Is Tezos worth investing into?

Personally, I do not own any Tezos mainly because I am currently not buying new projects. I am happy with my investments and currently looking to other financial investment opportunities. Although, if I was looking to add projects to my portfolio this would definitely be high on the list of projects to consider. I will be keeping a close eye on the progress of this project, and the impact it makes on the market.

Comments

Post a Comment