#MicroStrategy’s Saylor Shills Bitcoin Over Gold as Crypto Community Grows

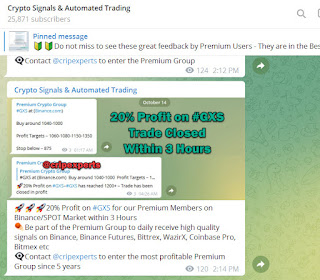

Visit - https://t.me/cryptosignalalert

FREE Crypto Signals Mobile APP -

https://play.google.com/store/apps/details?id=com.freecryptosignals.app

For more latest news update on Cryptocurrency, Free Binance future, Bybit, Bittrex signals & Binance future, Bybit Trading BOT visit above given Telegram group

IN BRIEF

Michael Saylor has described bitcoin as a "harder asset than gold" because its supply cannot be changed regardless of its price.

He said he is interested buying and holding BTC for the long term.

Bitcoin is attracting more newcomers.

Want to know more? Join our Telegram Group and get trading signals, a free trading course and daily communication with crypto fans!

MicroStrategy CEO Michael Saylor believes that bitcoin is a harder asset than gold and is less prone to losing value due to supply pressure.

In an interview with Stansberry Research’s Daniela Cambone, Saylor stated that gold is simply a commodity whose supply can be increased, unlike bitcoin.

According to Saylor, his recent decision to move $425 million of his company’s cash reserves into bitcoin was one that helps him. He also stated that the intervention of the Federal Reserve in expanding monetary supply over the past decade triggered fears about his US dollar reserves losing value over time.

Gold vs Bitcoin: Saylor’s Position

Saylor said that gold acts fundamentally like the commodity it is. This, in his words, means that if the price of gold goes up, so does the incentive for gold mining and prospecting, which will inevitably lead to increased gold supply, resulting in a price drop.

Bitcoin, on the other hand, has a fixed supply — no matter how high its price goes, there is no way to create more bitcoin than 21 million. This, in his opinion, makes bitcoin “a harder asset than gold.” According to him, this was what motivated him to convert 75 percent of his company’s reserves away from what he had earlier termed “a $500 million melting ice cube.”

Bitcoin Newbies

Saylor’s other premise for piling into bitcoin is that it offers an unprecedented amount of liquidity compared to any other security typically used in the financial markets. Unlike gold or the US dollar, he said, bitcoin can be liquidated in exchange for something else at any time of the day, all year round, anywhere on earth.

Bitcoin also attracted another new investor in recent days. Former UKIP MEP Godfrey Bloom announced on Twitter that he bought some bitcoin for the first time, saying that he already had plenty of gold and silver assets in his portfolio. Bloom is 70 years old and is looking to learn more about crypto.

Comments

Post a Comment