#The Truth About Bitcoin: People Aren't Using It As Currency

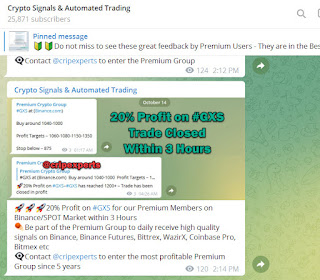

Visit - https://t.me/cryptosignalalert

FREE Crypto Signals Mobile APP -

https://play.google.com/store/apps/details?id=com.freecryptosignals.app

For more latest news update on Cryptocurrency, Free Binance future, Bybit, Bittrex signals & Binance future, Bybit Trading BOT visit above given Telegram group

Bitcoin was meant to serve as digital cash—yet it’s rarely used as a means of payment, with most holding the cryptocurrency for speculative purposes.

In brief

Bitcoin was originally billed as "a peer-to-peer electronic cash system," but most cryptocurrencies aren't used for payments.

Surveys have shown that the majority of Bitcoin is held for speculative purposes.

While some retailers accept Bitcoin, purchases have suffered from higher drop-out rates than cards and cash payments.

Bitcoin is the largest cryptocurrency by market cap. And from its inception, it’s been heralded as a form of digital cash; the replacement to the US dollar, the Chinese yuan and the British pound. Indeed, the original Bitcoin whitepaper by Satoshi Nakamoto describes it as a “peer-to-peer electronic cash system.”

But over a decade after its launch, the promise that shoppers would be happily using their Bitcoin addresses for payments in stores rings hollow.

To be clear, people do use Bitcoin and other cryptocurrencies to buy goods and services; it’s just that just the extent to which Bitcoin is used as a means of payment is dwarfed by its usage as a speculative investment, according to available data.

In a recent report titled 2020 Geography of Cryptocurrency, blockchain investigations firm Chainalysis found that 1% of cryptocurrency value sent to Africa came from merchants between June 2019 and July 2020. In China, that figure was 0.7%; in Eastern Europe, 0.84%; in Latin America, 0.96%; in the Middle East, 0.65%; in North America, 1.04%; in Europe, 1.08%.

And in May 2019, data from Chainalysis shows that just 1.3% of cryptocurrency transactions came from merchants between January and April of that year.

Looking specifically at Bitcoin, Chainalysis’s Market Intel platform shows that, in one week in September 2020, $62.5 million in Bitcoin went from services to exchanges and $53.9 million went from wallets to services. By comparison, $1.3 billion traveled between wallets.

That said, as Ryan Reiffert, a Texan business lawyer who represents startups and investors, told Decrypt, “just from looking at the ledger, it is essentially impossible to tell the difference between purchase transactions and investment transactions.” And even looking at businesses proclaiming to accept Bitcoin “will leave out all the independent contractors who might if asked, or those who don't advertise that they do.”

Why aren’t people using Bitcoin for transactions?

But using the available data as a benchmark, why isn’t Bitcoin more popular as a payment method?

It’s not that merchants don’t accept Bitcoin. A survey of 500 small and mid-sized businesses in the US by Zogby Analytics on behalf of HSB found that 36% accept cryptocurrency. And large organizations, such as Wikipedia, Microsoft and AT&T, accept Bitcoin.

And again, people do still buy things in Bitcoin. A spokesperson for Utah-based CoinZoom, which offers a crypto credit card, told Decrypt that customers have spent about $200,000 in Bitcoin each month for the past three months.

And Atlanta-based BitPay, a payment service provider that lets merchants accept Bitcoin, told Decrypt that the company processes $1 billion in Bitcoin payments each year.

But Bitcoin is far from mainstream. By comparison, in the first fiscal quarter of this year, Visa processed $2.3 trillion. So what’s causing the hold up for Bitcoin?

Recording success in Cryptocurrency Bitcoin is not just buying and holding till when bitcoin sky-rocks, this has been longed abolished by intelligent traders ,mostly now that bitcoin bull is still controlling the market after successfully defended the $50,000support level once again ad this is likely to trigger a possible move towards $60,000 resistance area regardless the dip.However , it's is best advice you find a working strategy by hub/daily signals that works well in other to accumulate and grow a very strong portfolio ahead. I have been trading with Mr Carlos daily signals and strategy, on his platform, and his guidance makes trading less stressful and more profit despite the recent fluctuations. I was able to easily increase my portfolio in just 3weeks of trading with his daily signals, growing my 0.2BTC to 2.2BTC. Mr Carlos daily signals are very accurate and yields a great positive return on investment. I really enjoy trading with him and I'm still trading with him, He is available to give assistance to anyone who love crypto trading and beginners in bitcoin investment , I would suggest you contact him on WhatsApp: +1(424)285-0682 and telegram : @IEBINARYFXfor inquires and profitable trading platform systems. Bitcoin is taking over the world.

ReplyDelete